From Big Four to High Tech, Tax Alum Blazes Trails

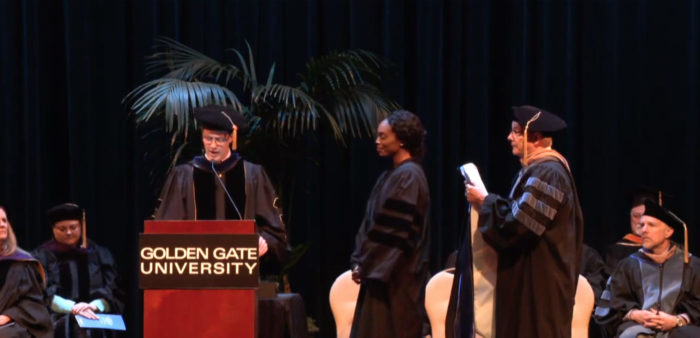

Robert Patterson credits GGU with giving him the confidence to embrace a non-traditional path toward an innovative and ambitious tax career with the Big Four, multinational companies, and the state of Kansas.

Robert Patterson, MST 2004, has enjoyed a storied career as a tax practitioner. Currently, he serves as a Microsoft director, ensuring internal control over financial reporting across all functional tax and trade areas. Previously, Robert worked on initiatives related to global and domestic tax compliance and policies with the Big Four accounting firms, multinational companies Walmart and American Express, and the state of Kansas where he helped draft tax legislation. But when he first began his career, he wasn’t sure where he was headed.

“Success is the journey, not the destination,” said Robert. “That’s how I always saw it. The path to success is not as defined as one would think. There are many roads and avenues.”

From Merrill Lynch to GGU

When Robert interned with Merrill Lynch during his senior year at Pacific Lutheran University, his instinct said to follow his curiosity about what he didn’t know. Today, Robert believes those unknowns can compel your career trajectory. At Merrill Lynch, he discovered that large organizations like Merrill Lynch incur expenses in the multimillions for tax consulting and compliance to the Big Four consulting firms. He diligently pursued his curiosity about that aspect of the tax area, which ultimately led him to GGU’s Master of Science in Tax program.

“There was a multitude of learnings that I got at GGU that differed from anything I’d seen previously,” said Robert. “IRS codes, payroll and employment tax, toolsets and databases. I gained tools that could really unlock doors to new opportunities.”

The Road to the Big Four

Robert used his time at GGU to build powerful networks with professors, students, and valuable professional contacts who he met on lunch breaks. He prepared exhaustively for an important career fair during hiring season and received offers from all Big Four firms. He also introduced his GGU peers—who were more introverted and cautious—to the hiring employers at the career fair.

“That day, 100 percent of my cohort got interviews. I took each person around to the hiring managers, and they all transitioned into job opportunities,” said Robert. “I knew how accomplished my colleagues were. Helping them transition into roles was the true reward of the process.”

Then, Robert made a bold decision. He rejected all of the employment offers from the Big Four. After asking detailed questions of the hiring managers and their staff, and analyzing the insights they shared, he realized accepting one of those offers could result in being pigeon-holed in one specific area.

“GGU was a light in my eyes to all the opportunities in front of me,” said Robert. “I saw myself at the Big Four but it was a path that I wanted to own. I wanted to position myself for greater autonomy and exposure to different areas within the tax world.”

CPA Rising Star

He took a position with a smaller firm in Washington state that appreciated his diverse areas of interest. There, he worked with clients and focused on specific tax issues that compelled him. Eventually, he transitioned to a new position with one of the Big Four, PricewaterhouseCoopers (PwC), in Seattle. Because he gained confidence and valuable experience at a smaller firm, he was able to leverage his advanced skills at PwC to work directly with partners and clients. Robert’s successes serving clients at PwC garnered two accounting awards: the Washington State Society CPA Rising Star award and PwC’s Chairman’s award. These experiences, and the empowerment they afforded, opened doors that led to greater opportunities at Ernst and Young, multinational companies Walmart and American Express, and the state of Kansas, where he drafted two bills that were enacted. The road eventually led Robert and his wife to move to the Pacific Northwest, where he joined Microsoft as a program manager overseeing Tax and Trade. Along the way, he earned an MBA from Morehead State University, an MS in Operations Management from University of Arkansas-Fayetteville, and a graduate certificate in State and Local Taxation from the University of Wisconsin-Milwaukee.

The Power of Education

“My parents instilled important values in me,” said Robert. “My father was raised in Philadelphia and when he retired from the U.S. Air Force, he continued working. He was always learning computer science applications. I benefited from his energy, learnings, and knowledge-sharing.”

Robert’s mother, raised in Alabama, was a teenager in the Selma, Alabama Bloody Sunday protest. She was among the young protestors who survived the brutality of Alabama State Troopers. Following this powerful and enduring life experience, she enrolled in a local community college in Alabama, post-segregation. In the face of aggressive discrimination, she showed up every day well-prepared and earned high marks, knowing that the value lay in simply being present in the classroom. Then, she made a bold decision. She moved her family as far north as they could go—to Alaska, where she completed her BS in Nursing and returned later to earn her PhD.

“She took those learnings about diligence and preparation throughout her life. Those thinkings and styles that my parents gave me influenced me as a young man and as a professional,” said Robert. “I don’t have to repeat what they have done, but through empathy I was able to learn from them and understand their experience.”

Throughout Robert’s career, his experience at GGU has continued to reverberate. He’s referred people he’s met at other institutions and employers—40 individuals in total—to GGU.

“I’ve now taught at quite a few institutions,” said Robert. “And, from the post-graduate perspective, I’ve never seen professors who put in the time and investment like faculty at GGU. That focus on individuals has stayed with me. There’s truly this ‘you matter’ component to what GGU delivers.”